michigan property tax rates by township

This can be obtained from your assessment notice or by accessing your tax and assessing records on our Property Tax Search website. Taxes Tax Comparison Ordered by Millage Rate.

What Do Your Property Taxes Pay For

Tax rate per 1000 x Taxable Value 1000 yearly rate.

. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000. Welcome to Springfield Charter Township MI. To view all county data on one page see Michigan property tax by.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. For more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Ad Get a Vast Amount of Property Information Simply by Entering an Address. Macomb County has one of the highest median property taxes in the United States and is ranked 218th of the 3143 counties in order of median property taxes. 50 fee is added.

Macomb County collects on average 174 of a propertys assessed fair market value as property tax. 2022 Property Tax Calendar. 15 hours agoFor every 1 mill a person with a taxable value of 100000 pays 100 in property taxes.

You Can See Data Regarding Taxes Mortgages Liens Much More. Michigan General Property Tax Act. Property is forfeited to county treasurer.

The highest rate is 815 mills in River Rouge cityRiver Rouge schools in Wayne County. We accept cash personal checks bank checks MasterCard Discover and Visa. The average effective rate including all parts of the.

How to Calculate Taxes. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. For existing homeowners please enter the current taxable value of your property.

84 rows To find detailed property tax statistics for any county in Michigan click the countys name in the data table above. Send your check money order to. County Treasurer adds a 235 fee.

Pursuant to the State of Michigan General Property Tax Act 206 MCL21144. There is a 395 charge for debitcredit card use under 160 and a 2. 430 pm on Sept.

The average effective property tax rate in Macomb County is 168. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. Beginning March 1 2023 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North Telegraph Pontiac Michigan 48341 with additional penalties.

If you were in business as of December 31 you are responsible for the following years Summer and Winter taxes. Property tax information is available on the Oakland County 24 Hour Tax Hotline by dialing 248-858-0025 or toll. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313 mills.

You will then be prompted to select your city village or township along. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected. Summer Tax Bills - Property taxes may be paid online or at Township Hall beginning.

We are open Monday through Friday from 830 am to 430 pm. 45 fee is added. 23060 Grand Ledge of Total.

1 day agoTownship Supervisor Nathan Skibbe said last week part of the reason a rate hike was needed was because the city increased rates. Census Bureau The Tax Foundation and various state and. Pittsfield Charter Township 6201 W.

Lansing and has one of the highest property tax rates in the state of Michigan. The median rate in Michigan is 296 mills. Interest increases from 1 per month to 15 per month back to 1st prior year.

Data sourced from the US. For every 1 mill a person with a taxable value of 100000 pays. 14 hours agoAll of this comes on the heels of DTE Energys proposed an 88 rate increase to raise 388 million for grid improvements.

The lowest property tax rate in the state is 162 mills in Leelanaus Cleveland Township within the Glen Lake school district. September 14 - September 30. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way.

This data is based on a 5-year study of median property tax rates on owner-occupied homes in Michigan conducted from 2006 through 2010. 14 the following interest schedule applies. Many residents have pushed the Michigan Public Service Commission to.

A personal visit is made to each property between August September. 2021-2022 Statutory Tax Collection Distribution Calendar. Property Tax Due.

Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. Estimate Your Property Taxes Millage Rate Information. For payments made after 430 pm Sept.

For new homeowners please contact the. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

How To Calculate Michigan Property Taxes On Your Investment Properties

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Taxes The Treasurer Village Of Pinckney

Property Tax How To Calculate Local Considerations

Taxes And Assessing Lima Township

Frequently Asked Questions About The Public Safety Millage Pittsfield Charter Township Mi Official Website

2021 Public Safety Millage Request Pittsfield Charter Township Mi Official Website

Treasurer S Office And Taxes Littlefield Township Board Of Trustees

Tax Bill Information Macomb Mi

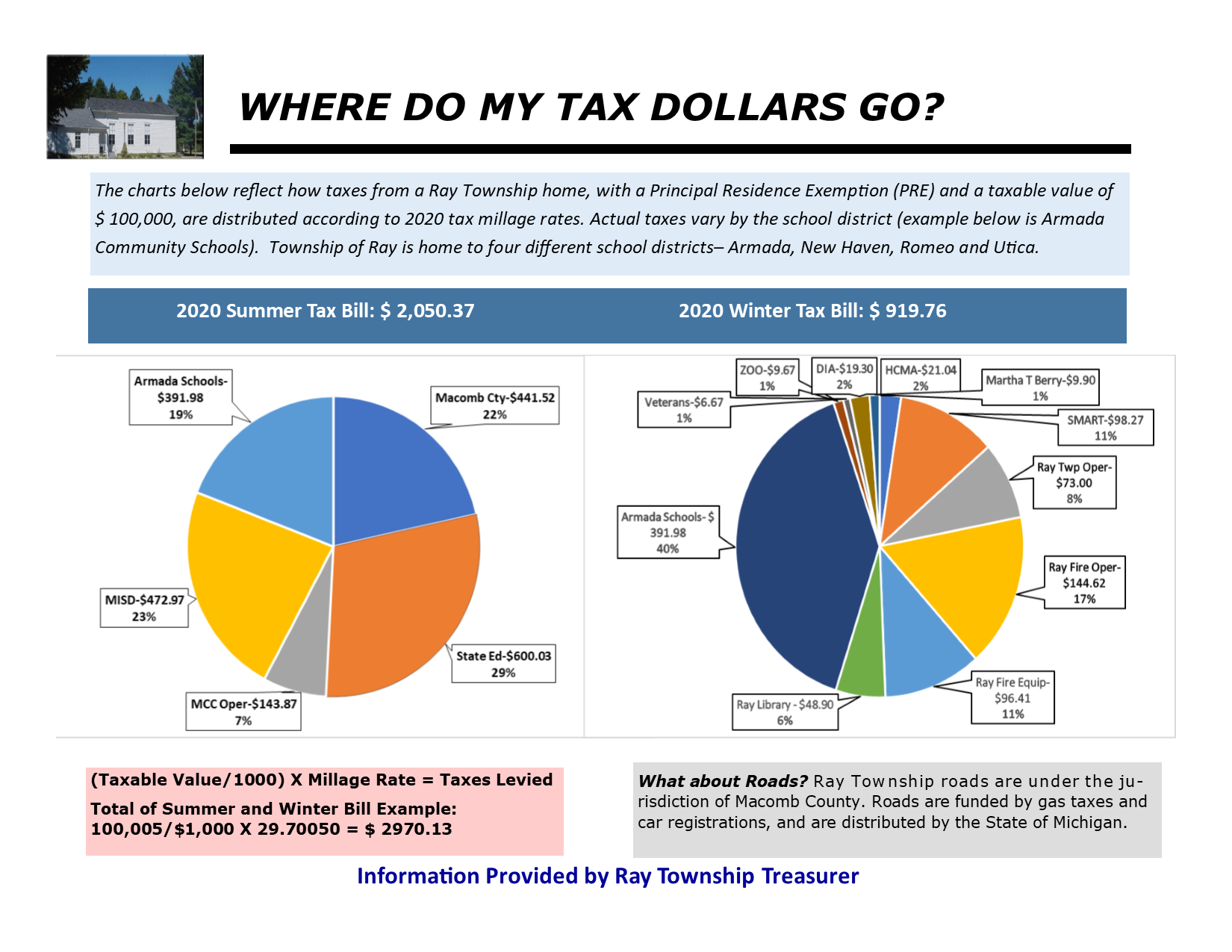

Treasurer S Office Township Of Ray

Property Taxes Hartland Township Michigan

Winter Tax Bill Example Macomb Mi